Unit of production depreciation calculator

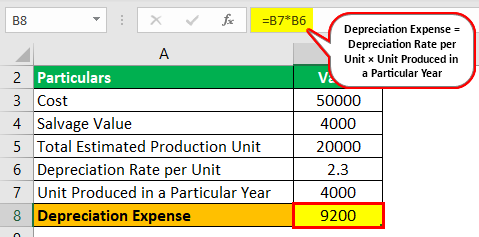

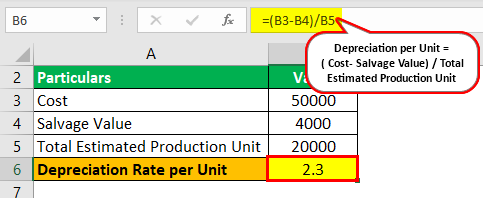

Dividing the 480000 by the machines useful life of 240000 units Units of Production Depreciation the depreciation will be 2 per unit. Unit of Production Depreciation Formula Calculate the book value of a three-year-old.

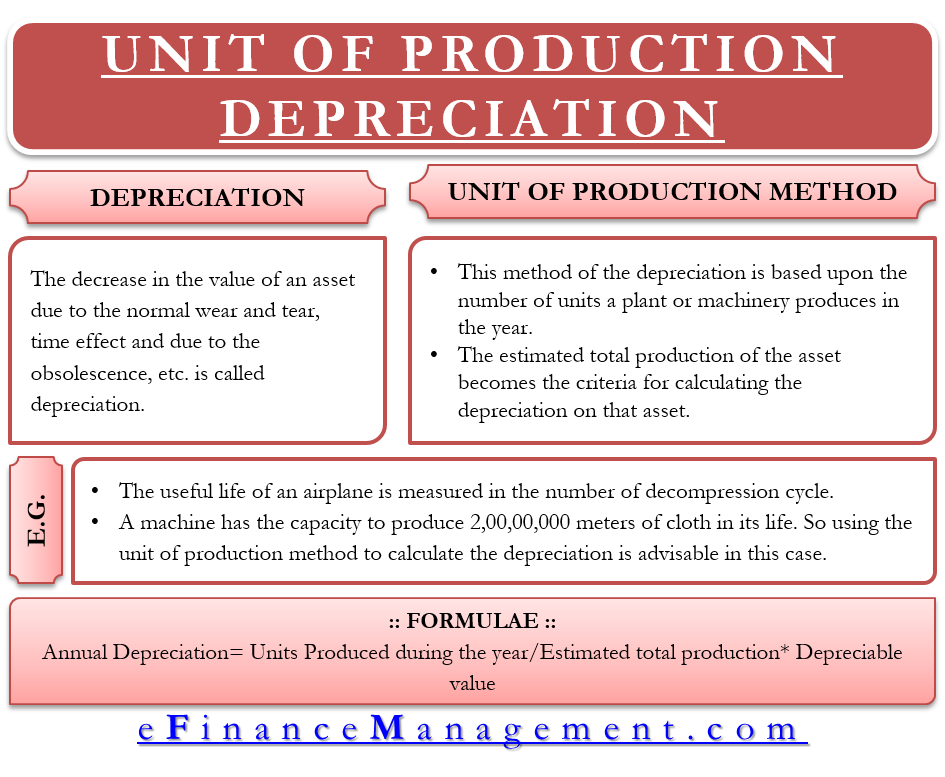

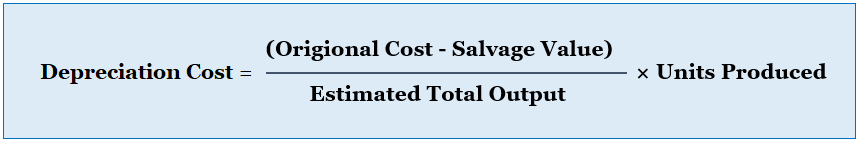

Depreciation Formula Calculate Depreciation Expense

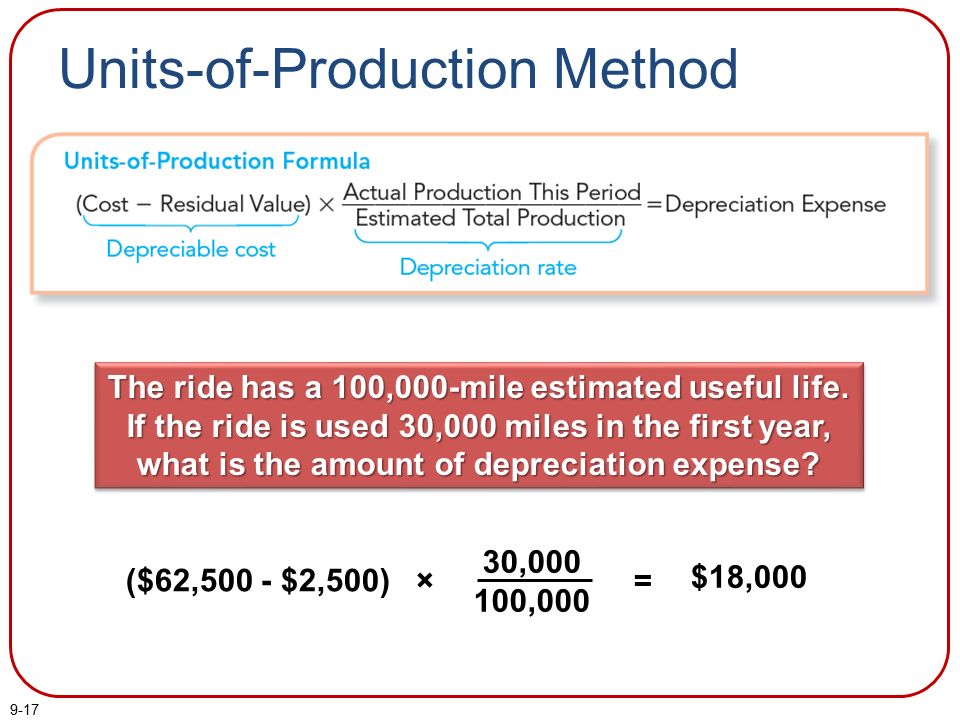

Depreciation for year 1 0081 x 20000.

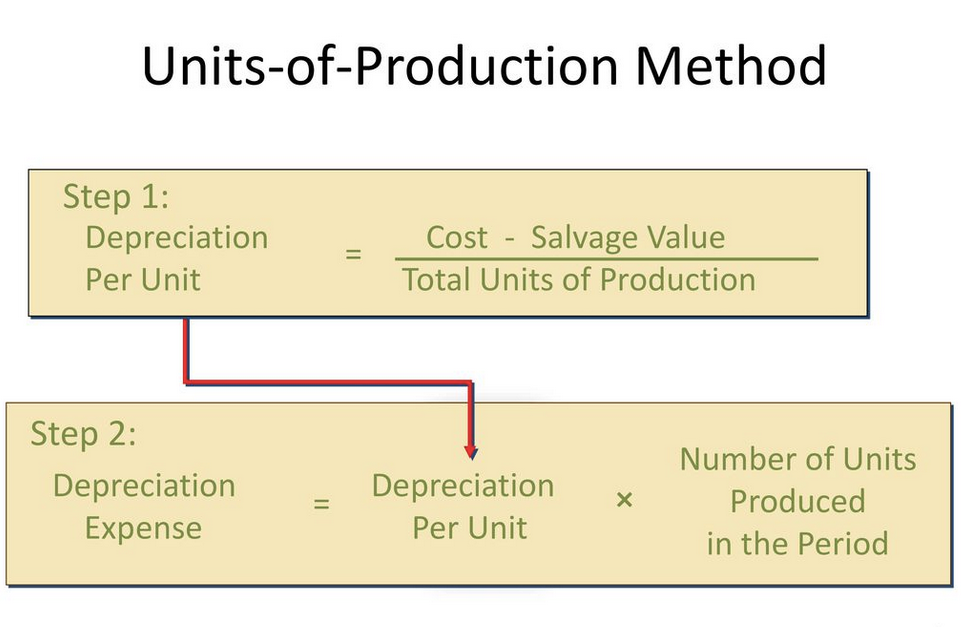

. Estimated Unit of Production. Depreciation for year 1 Unit of Production Rate x Actual Units Produced. During the first quarter of activity Pensive Dirt extracts 10000 tons of gravel which results in the following depreciation expense.

Dividing the 480000 by the machines useful life of 240000 units the depreciation will be 2 per unit. This calculator uses the units-of-production UOP depreciation method to compute both the depreciation per unit and total annual depreciation for an item given the items original. To find the unit production rate you must know the original.

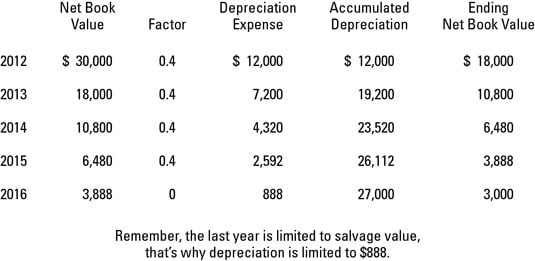

At the end of five years the asset will have a book value of 10000 which is calculated by subtracting the accumulated depreciation of 48000 5 9600 from the cost. Estimated family contribution calculator 2015. Depreciation for year 1.

If the asset will produce 200 units in its first year period the units of production depreciation value will be the 8000 20000 - 4000 400 200. If the machine produces 10000 units in the. Dragalia lost stat calculator.

Sum of years digits. Depreciation Expense Unit Production Rate x Units Produced. While the estimated salvage value at the end of its life will be 20000.

Divide the assets cost minus its salvage value by the total units you estimate the equipment to generate during its useful life to compute units of production depreciation. Use this calculator to calculate depreciation based on level of production for each period. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of.

040 depreciation cost per ton x 10000 tons of gravel 4000 depreciation expense Terms Similar to Units of Production Method The units of depreciation method is also known as the units of activity method. For year 1. The units of production depreciation formula is.

This calculator uses the units-of-production UOP depreciation method to compute both the depreciation per unit and total. The estimated production capability at the time of purchase for this plant was 10000000. Units of production is a differently worded version of our activity depreciation.

Calculating Machines Depreciation Expense.

Unit Of Production Depreciation Efinancemanagement

Units Of Production Depreciation Calculator Efinancemanagement

How Do I Calculate Depreciation Formula Guides Examaples

Units Of Production Depreciation Definition And How To Calculate Bookstime

Depreciation Methods Dummies

Unit Of Production Depreciation Method Formula Examples

Calculating Depreciation Unit Of Production Method

Unit Of Production Depreciation Method Formula Examples

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Units Of Production Depreciation Calculator Double Entry Bookkeeping

How To Calculate Units Of Production Depreciation In Excel

Depreciation Formula Calculate Depreciation Expense

Unit Of Production Depreciation Method Formula Examples

Long Lived Tangible And Intangible Assets Ppt Download

Depreciation Formula Examples With Excel Template